Imagine waking up every day knowing your bills are covered, your future is secure, and you don’t need to work unless you want to. That’s the essence of financial independence (FI)—and it’s a goal more and more people are striving for.

In this article, you’ll learn what financial independence really means, how it differs from early retirement, and the practical steps to achieve it, even starting from zero.

What Is Financial Independence?

Financial independence means having enough assets or income streams to cover your living expenses without relying on a traditional job.

You are financially independent when:

- Your passive income (from investments, rental properties, etc.)

- Covers your basic expenses

- Without needing to work actively

It’s not about being rich—it’s about freedom and security.

Financial Independence vs. Early Retirement

They’re related, but not the same:

- Financial Independence = You don’t need to work, but you might still choose to

- Early Retirement = You stop working entirely, often after reaching FI

Many people pursue FIRE (Financial Independence, Retire Early), but FI can also mean more freedom to work on what you love, not just to stop working.

Why It Matters

- Freedom of choice

- Reduced stress and anxiety

- Flexibility to travel or start projects

- Better quality of life

- Peace of mind for emergencies

Whether you want to retire early or just escape paycheck-to-paycheck living, FI gives you control.

7 Steps to Achieve Financial Independence

1. Define Your “FI Number”

This is how much money you need to reach independence.

FI Number = Annual Expenses × 25

Example: If you need $24,000/year to live → $24,000 × 25 = $600,000

(Assumes a 4% safe withdrawal rate from investments)

2. Track All Your Expenses

Before you can build wealth, you need to know where your money is going. Use apps like:

- YNAB

- Mint

- PocketGuard

Find your true cost of living.

3. Cut Unnecessary Spending

The lower your expenses, the lower your FI number.

Focus on:

- Housing

- Transportation

- Food

- Subscriptions

- Impulse buys

Cutting spending isn’t deprivation—it’s buying your freedom sooner.

4. Increase Your Income

You can only cut so much—but you can always earn more.

Ideas:

- Ask for a raise

- Start a side hustle

- Freelance

- Build a business

- Create digital products

The bigger your gap between income and expenses, the faster you’ll reach FI.

5. Invest Aggressively and Consistently

Saving isn’t enough. You need to grow your money.

Best options:

- Index funds (like the S&P 500)

- ETFs

- Retirement accounts (401(k), IRA)

- Real estate (for passive rental income)

Automate contributions and stay consistent.

6. Avoid Lifestyle Inflation

When you earn more, don’t spend more.

Keep your lifestyle modest—even as your income increases—and redirect the surplus into investments.

7. Revisit Your Plan Annually

Life changes. So should your FI strategy.

Track your:

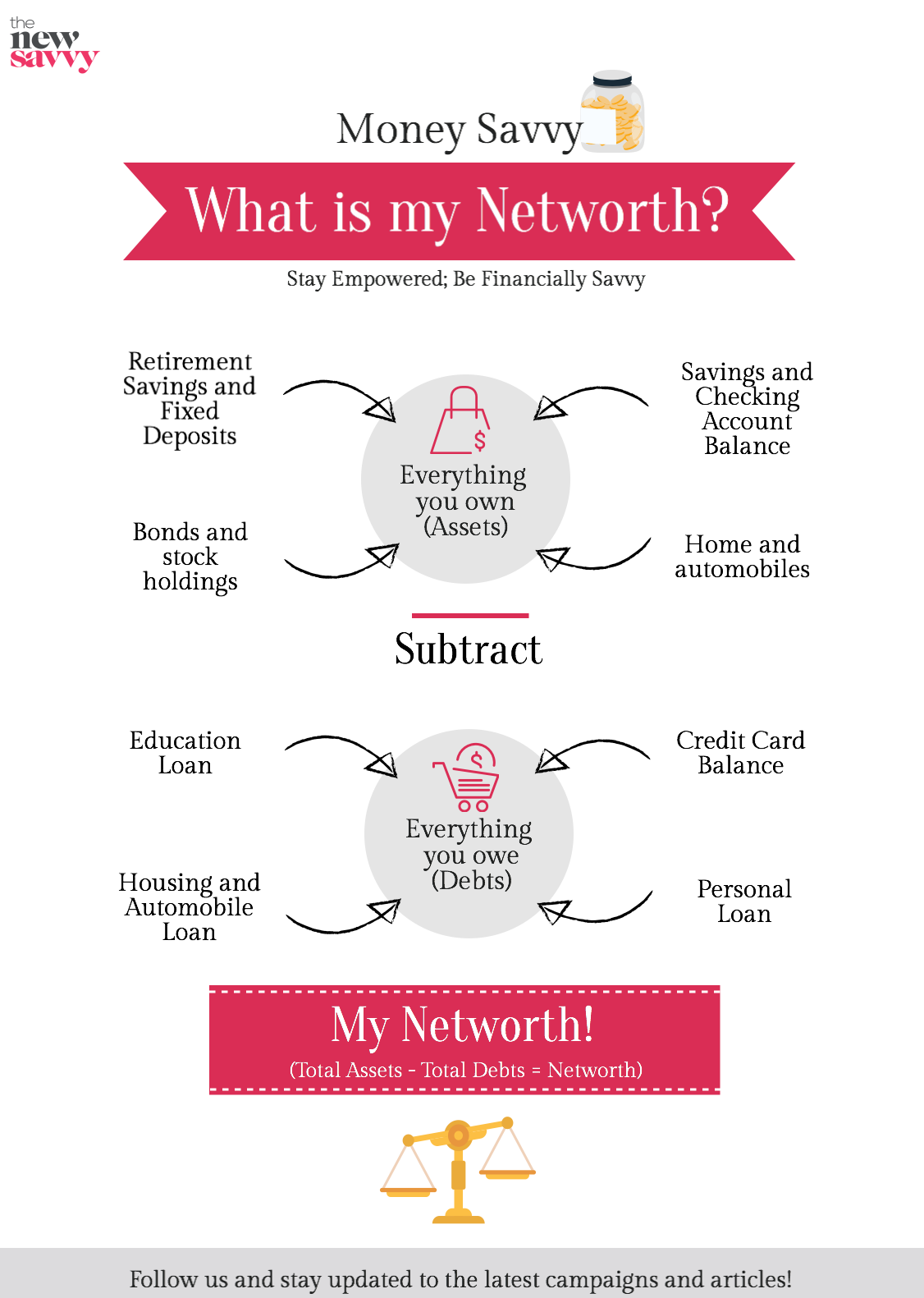

- Net worth

- Investment growth

- Spending habits

- Progress toward your FI number

Adjust as needed and stay the course.

Final Thoughts: Financial Independence Is for Everyone

You don’t need to earn six figures to become financially independent. What you need is clarity, discipline, and time.

Start with small changes. Stay consistent. Watch your freedom grow.