If there’s one concept in finance that can truly change your life, it’s compound interest. Often referred to as the eighth wonder of the world, compound interest is how your money makes more money—passively and over time.

Whether you’re saving or investing, understanding compound interest can help you make smarter financial decisions and build long-term wealth.

What Is Compound Interest?

Compound interest is the interest you earn on both the initial amount you deposit (the principal) and the interest that has already been added.

In other words: you earn interest on your interest.

Simple vs. Compound Interest

| Type | You Earn Interest On | Growth Over Time |

|---|---|---|

| Simple Interest | Only the original amount (principal) | Linear |

| Compound Interest | Principal + past interest | Exponential (faster growth) |

Real-Life Example

Let’s say you invest $1,000 at an annual interest rate of 5%, compounded yearly.

- Year 1: $1,000 + $50 = $1,050

- Year 2: $1,050 + $52.50 = $1,102.50

- Year 3: $1,102.50 + $55.13 = $1,157.63

After 10 years, you’ll have $1,628.89, without adding any new money. That’s the power of compounding!

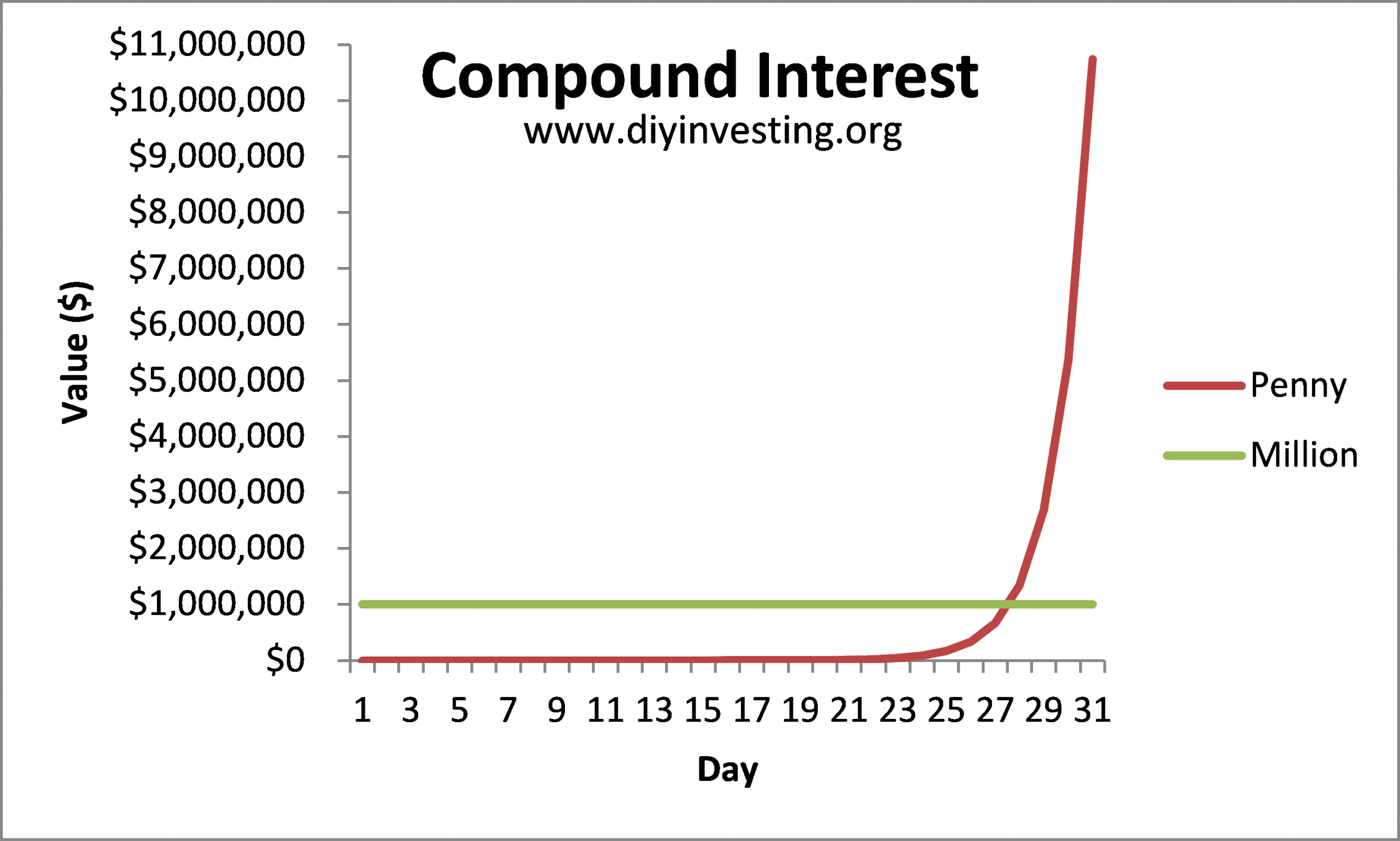

Now imagine you invest monthly for 10, 20, or 30 years—your wealth can multiply dramatically.

The Formula for Compound Interest

The math behind it:

A = P(1 + r/n)ⁿᵗ

Where:

- A = final amount

- P = principal (starting amount)

- r = annual interest rate

- n = number of compounding periods per year

- t = number of years

Don’t worry—you don’t need to calculate this manually. Use apps or online calculators (like Investor.gov or NerdWallet) to estimate your compound growth.

Factors That Influence Compound Growth

1. Time

The longer your money stays invested, the more powerful compound interest becomes. Start early—even with small amounts.

2. Rate of Return

Higher interest or investment returns accelerate growth. But always consider the risk level of higher-return options.

3. Frequency of Compounding

Daily or monthly compounding earns faster than yearly compounding.

4. Consistent Contributions

Adding money regularly (e.g., monthly) greatly increases the compounding effect.

Where Can You Earn Compound Interest?

- High-yield savings accounts

- Certificates of deposit (CDs)

- Retirement accounts (401(k), IRA)

- Reinvested dividends in stock funds

- Compound crypto accounts (with caution)

Not all investments offer compound interest—but many grow similarly by reinvesting returns.

Compound Interest in Investing vs. Saving

| Savings Accounts | Investments |

|---|---|

| Lower returns (2–5%) | Higher potential returns (6–12% or more) |

| Lower risk | Higher risk |

| Great for short-term safety | Best for long-term wealth |

For long-term goals, investing benefits more from compounding than saving alone.

Common Mistakes to Avoid

- Waiting too long to start

- Withdrawing interest early

- Ignoring inflation

- Focusing only on principal growth

- Not reinvesting dividends or returns

Final Thoughts: Start Small, Think Big

Compound interest is a powerful wealth-building tool that rewards patience, consistency, and time. Whether you’re saving in a bank or investing in the stock market, compounding can turn modest amounts into financial freedom.

Start today—even if it’s just $10 or $50 per month. Your future self will thank you.