Whether you want to buy a house, travel the world, or retire early, it all starts with one thing: a financial goal. Without clear financial goals, managing money becomes reactive instead of strategic.

In this article, you’ll learn what financial goals are, the different types, and how to set and achieve them with clarity and confidence.

What Are Financial Goals?

Financial goals are specific objectives you want to achieve with your money. They guide how you save, spend, invest, and make decisions.

Examples:

- Build a $1,000 emergency fund

- Pay off credit card debt

- Save $10,000 for a home down payment

- Retire at 55 with $500,000

- Start a business with $15,000 in savings

They help you turn your money into freedom and purpose.

Types of Financial Goals

1. Short-Term Goals (0–2 years)

- Build an emergency fund

- Pay off a small loan or credit card

- Save for a vacation

- Buy a new phone or laptop

2. Medium-Term Goals (2–5 years)

- Save for a car

- Build a house deposit

- Get a professional certification

- Relocate to a new city

3. Long-Term Goals (5+ years)

- Buy a home

- Fund a child’s education

- Retire early or comfortably

- Achieve financial independence

Why Setting Financial Goals Matters

- Provides direction and motivation

- Helps you prioritize spending

- Keeps you focused during financial stress

- Helps you measure progress

- Makes long-term planning easier

Without goals, it’s easy to waste time, energy, and money.

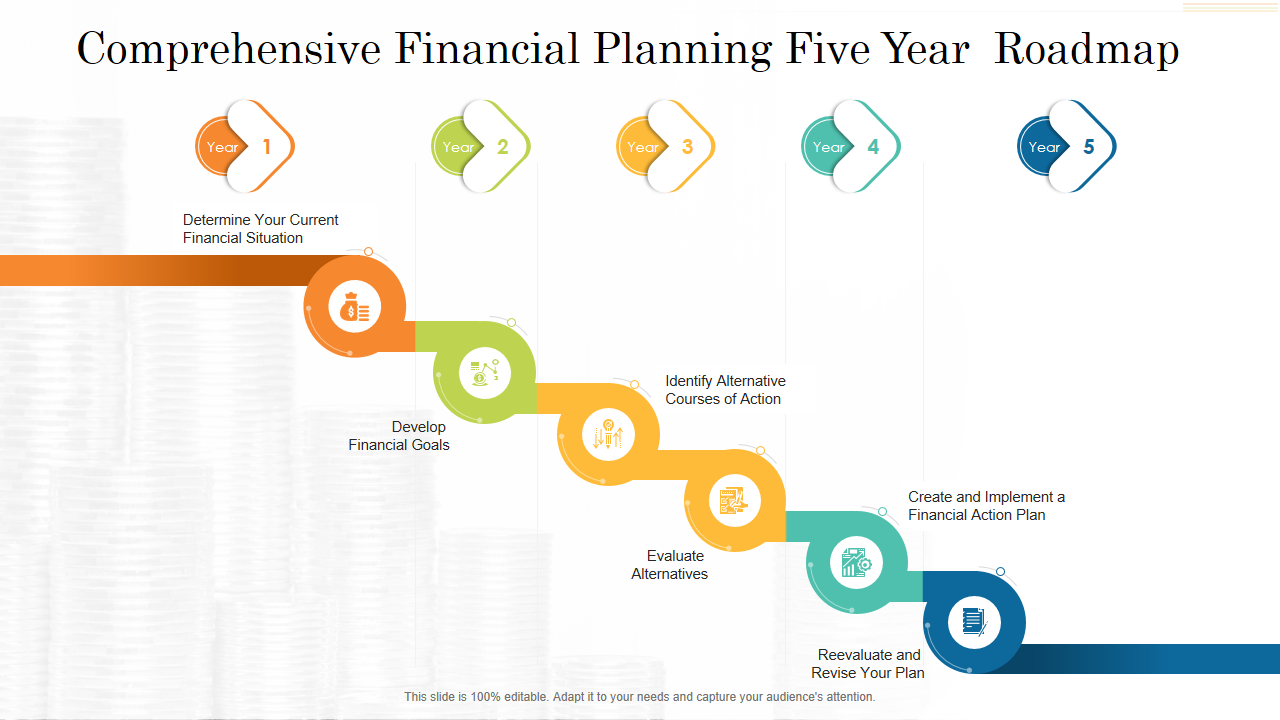

How to Set Financial Goals (Step-by-Step)

1. Identify What Matters Most

Ask yourself:

- What are your dreams or values?

- What do you want money to do for you?

2. Set SMART Goals

Make your goals:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

Example: “Save $5,000 in 12 months to move into a new apartment.”

3. Break It Down Into Milestones

Divide big goals into monthly or weekly targets. It makes them less overwhelming.

Example: Save $417/month = $5,000 in 12 months.

How to Stay on Track

- Track your progress weekly or monthly

- Automate savings toward each goal

- Celebrate milestones to stay motivated

- Adjust goals as life changes

Tools to Help You Set and Track Goals

- Budgeting apps like YNAB, Mint, or Monarch Money

- Spreadsheets or goal-tracking templates

- Vision boards or financial planners

- Notes app + calendar reminders

Final Thoughts: Your Goals = Your Financial Roadmap

Setting clear financial goals gives your money a mission. Whether you’re working toward stability or building wealth, knowing what you’re aiming for makes every step purposeful.

Start with one goal. Write it down. Take your first small step today—and move closer to the life you want.