Organizing your personal finances may feel overwhelming at first, especially if you’ve never done it before. However, this initial step is key to achieving financial stability and independence. In this comprehensive guide, you’ll discover how to start from zero and take control of your financial life confidently.

Why Organizing Your Finances Matters

Many people live on “autopilot,” unaware of how much they earn, spend, or where their money goes. That lack of clarity often leads to debt, stress, and poor financial decisions. Getting your finances organized is the crucial first step toward reaching goals, preparing for the unexpected, and living with peace of mind.

Know Your Income and Expenses

Begin by tracking exactly how much you earn and how much you spend. Even if your income varies, calculate an average to serve as your baseline. Record every source of income and every expense — even small ones like a coffee or bus fare. This insight enables smarter decision-making.

Create a Monthly Budget

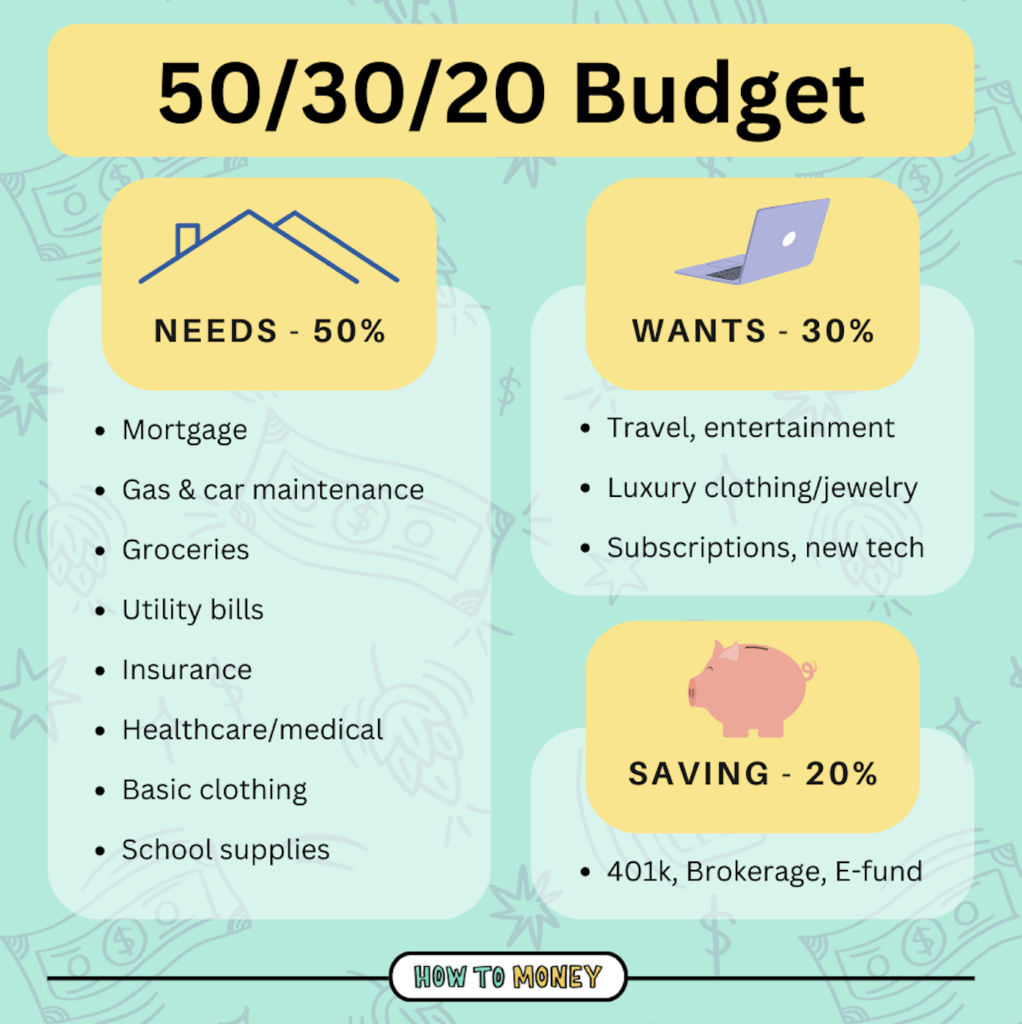

Think of your monthly budget as your financial roadmap: it shows where your money goes and where it could go instead. Try the 50/30/20 rule as a starting point:

- 50% for necessities (rent, groceries, transport)

- 30% for wants (leisure, non-essential shopping)

- 20% for savings and debt reduction

Adjust the percentages to fit your own situation, but this split is a solid framework for beginners.

Separate Fixed vs. Variable Expenses

Fixed expenses remain consistent each month: rent, utilities, subscriptions. Variable expenses — like dining out, gifts, clothes — fluctuate. Knowing the difference helps you identify where to cut back if needed.

Set Financial Goals

Money management without purpose can feel dull. Define clear goals—like paying off debt, building an emergency fund, saving for travel, or starting investments—with specific amounts and deadlines. Goals keep motivation high.

Track Every Expense

This may be the hardest habit, but it’s vital. Logging every purchase gives you full control over your finances. Use a notebook, spreadsheet, or apps like Mint, YNAB, or PocketGuard — consistency matters more than the tool.

Build an Emergency Fund

An emergency fund is money saved for unexpected events—job loss, medical bills, urgent repairs. Aim for 3–6 months’ worth of living expenses. Start small; saving $20 or $50 monthly adds up if done consistently.

Cut Unnecessary Expenses

Tracking your budget reveals spending leaks—unused subscriptions, excessive takeout, impulse buys. Even small cuts can add up to big savings over time.

Use Credit Cards Wisely

Credit cards can help or harm your finances. Avoid maxing out credit or relying on it for daily expenses. Keep credit utilization below 30% of your income, and always pay the full balance when possible to avoid interest.

Avoid Impulsive Debt

Before taking a loan or financing a purchase, ask yourself if it’s necessary and whether you can comfortably repay it. Impulsive debt is the root of many financial problems.

Keep Learning

Financial education evolves with your journey. Read books, listen to podcasts, watch videos, or follow blogs that teach smart money practices. Knowledge helps you make better decisions consistently.

Adapt to Your Life

There’s no one-size-fits-all formula. The key is honesty with yourself, starting with what’s manageable, and gradually improving over time.

Your Financial Journey Begins Now

Organizing your personal finances is about awareness and discipline—not income level. A simple plan combined with consistent habits can reshape your financial life and bring lasting peace of mind.

Now that you’re equipped to begin, why not take action today? Every small step counts—and there’s no better time than now.