Your net worth is one of the most important numbers in your financial life. It’s not about ego—it’s about clarity. Knowing your net worth helps you understand where you are, track your progress, and make better decisions for your future.

In this article, you’ll learn what net worth is, why it matters, and how to calculate and grow it—step by step.

What Is Net Worth?

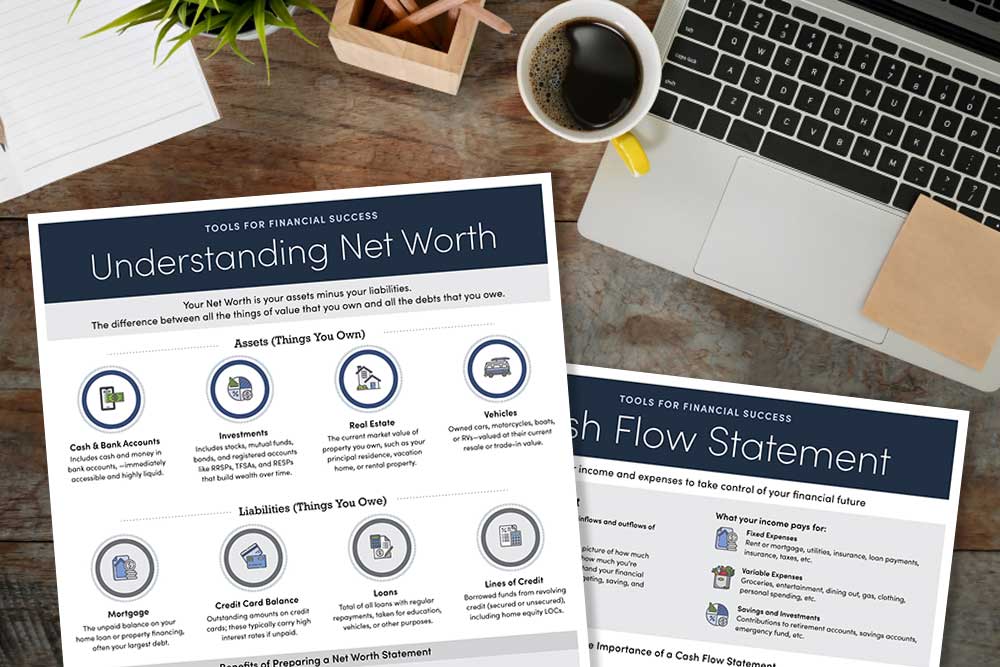

Your net worth is the difference between what you own and what you owe.

Net Worth Formula:

Net Worth = Total Assets − Total Liabilities

If your assets are worth more than your debts, you have a positive net worth. If your debts exceed your assets, you have a negative net worth—and that’s okay as a starting point.

Examples of Assets

Assets are everything you own that has value.

- Cash and bank balances

- Investments (stocks, bonds, crypto)

- Real estate (home, land)

- Retirement accounts (401(k), IRA, etc.)

- Vehicles (at market value)

- Valuables (jewelry, collectibles)

Examples of Liabilities

Liabilities are everything you owe.

- Credit card debt

- Student loans

- Mortgage

- Car loans

- Personal loans

- Medical debt

Step-by-Step: How to Calculate Your Net Worth

1. Make a List of All Assets

Include:

- Account balances

- Property market values

- Investment account balances

- Retirement accounts

- Any other valuables

2. Make a List of All Debts

Add up all current balances you owe on:

- Loans

- Cards

- Mortgages

3. Subtract Total Liabilities from Total Assets

The result is your net worth.

Why Net Worth Is Important

- It gives you a clear financial snapshot

- Helps you track progress over time

- Shows how well you’re building wealth

- Reveals if you’re over-leveraged or too dependent on debt

- Encourages smarter decisions about saving, spending, and investing

How Often Should You Check It?

- Once a month: if you’re actively working on debt or saving

- Once a quarter: if your finances are stable

- Once a year: for long-term planning

Use spreadsheets, notebooks, or tools like:

- Personal Capital

- Mint

- YNAB

- Tiller Money

How to Grow Your Net Worth

1. Increase Your Assets

- Save consistently

- Invest in appreciating assets (stocks, real estate)

- Build multiple income streams

2. Reduce Your Liabilities

- Pay down high-interest debt

- Avoid new unnecessary debt

- Refinance loans at lower interest rates

3. Avoid Lifestyle Inflation

Just because you earn more doesn’t mean you have to spend more. Maintain or improve your savings rate as your income increases.

Final Thoughts: Know the Score, Own the Game

Calculating your net worth is like checking your GPS—without it, you’re just guessing. The goal isn’t perfection; it’s progress. Even if your net worth is negative today, tracking it helps you move in the right direction.

Start now. Know your number. Then, take consistent steps to grow it.