Investing isn’t one-size-fits-all. What works for one person may not work for another—and that’s why identifying your investor profile is one of the most important first steps when entering the world of investments.

In this article, we’ll explore what an investor profile is, how to identify yours, and how it affects the types of assets you should include in your portfolio.

What Is an Investor Profile?

Your investor profile—also called a risk profile—is a description of how comfortable you are with investment risk, how long you plan to invest, and what your financial goals are.

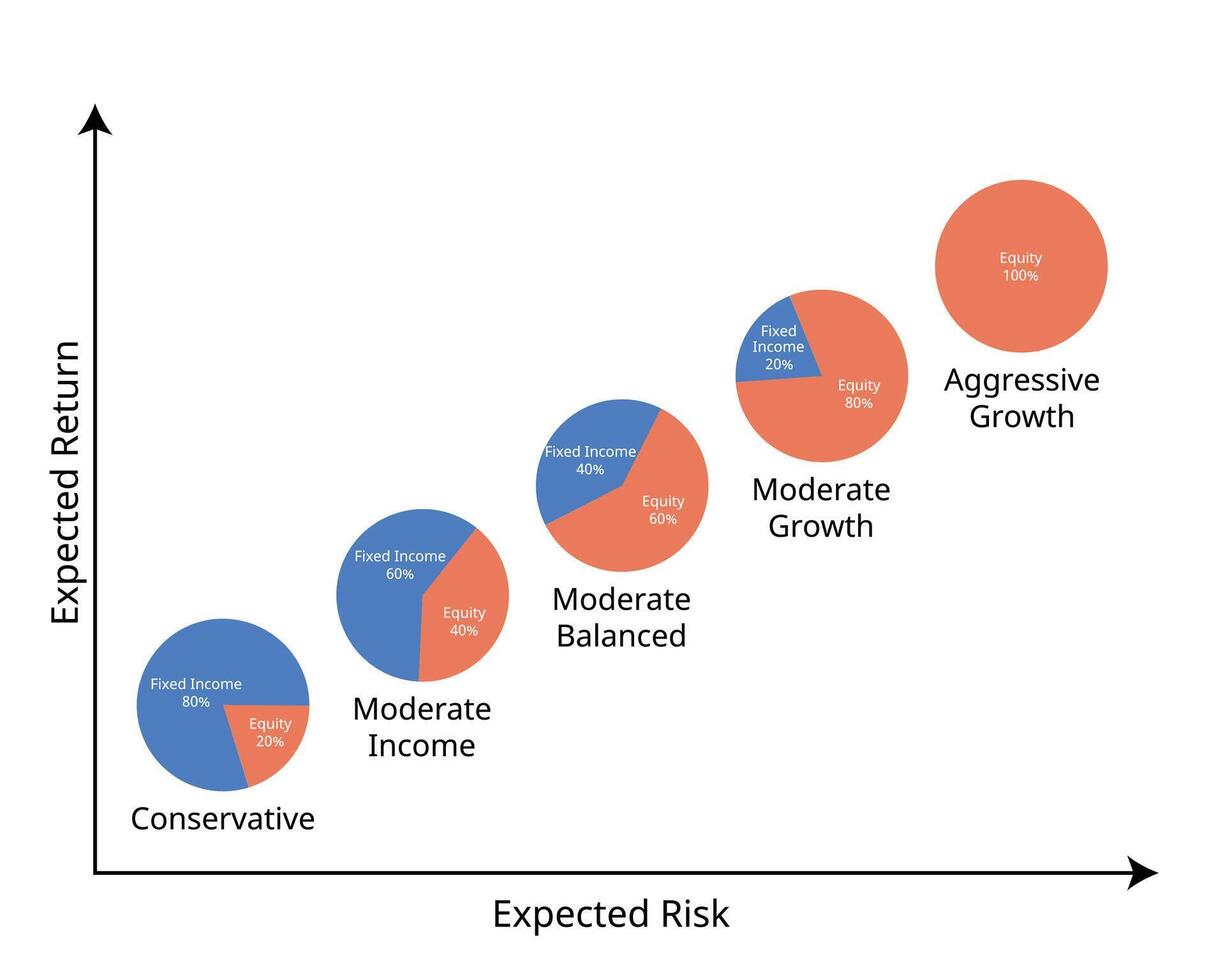

It’s typically categorized into three main types:

- Conservative

- Moderate

- Aggressive

Each profile reflects how much risk you’re willing to take and how much fluctuation you can handle in the value of your investments.

Why It Matters

Knowing your investor profile helps you:

- Choose investments that match your comfort level

- Avoid panic during market drops

- Build a balanced portfolio

- Stay focused on long-term goals

- Make better decisions based on logic—not emotion

The Three Main Types of Investor Profiles

1. Conservative Investor

- Risk Tolerance: Low

- Primary Goal: Preserve capital

- Typical Assets: Treasury bonds, fixed-income funds, CDs

- Ideal For: Retirees, people close to major life goals (home purchase, college)

Conservative investors value stability and security over high returns.

2. Moderate Investor

- Risk Tolerance: Medium

- Primary Goal: Balanced growth and stability

- Typical Assets: A mix of fixed income and equities (e.g., 60% bonds / 40% stocks)

- Ideal For: Long-term investors with medium timeframes

Moderate investors seek a balance between growth and protection.

3. Aggressive Investor

- Risk Tolerance: High

- Primary Goal: Maximize long-term returns

- Typical Assets: Stocks, ETFs, real estate, international funds

- Ideal For: Young investors, high earners, risk-tolerant individuals

Aggressive investors are willing to accept short-term volatility for the chance of bigger long-term gains.

How to Identify Your Investor Profile

Ask yourself these questions:

- How would you react if your investments lost 20% in one month?

- a) Panic and sell everything

- b) Stay calm but concerned

- c) Buy more at a discount

- When do you plan to use the money you’re investing?

- a) Within 2 years

- b) In 5–10 years

- c) In 10+ years

- What’s more important to you: protecting your money or growing it?

- a) Protecting it

- b) Both

- c) Growing it

Mostly A = Conservative

Mostly B = Moderate

Mostly C = Aggressive

You can also take online quizzes from brokers like Vanguard, Charles Schwab, or Fidelity to determine your risk profile professionally.

How Your Profile Should Guide Your Portfolio

| Profile | Stocks | Bonds | Alternatives | Liquidity |

|---|---|---|---|---|

| Conservative | 20–30% | 60–70% | 0–10% | High |

| Moderate | 40–60% | 30–50% | 10–20% | Medium |

| Aggressive | 70–90% | 10–20% | 10–30% | Low |

Your asset allocation should evolve over time as your goals, income, or life circumstances change.

Mistakes to Avoid

- Copying other investors without considering your profile

- Reacting emotionally to market swings

- Investing everything in one asset class

- Not rebalancing your portfolio regularly

Knowing your profile helps you invest smarter, not harder.

Final Thoughts: Know Yourself Before You Invest

The best investment strategy starts with self-knowledge. Identifying your investor profile helps you build a portfolio that’s aligned with your goals, your values, and your ability to handle risk.

Once you know who you are as an investor, the rest becomes much easier.