Creating an effective monthly budget is one of the most important pillars of financial health. It doesn’t matter whether you earn a lot or a little — the key is understanding exactly how your money is used each month. A well-built budget helps you avoid debt, control spending, save more, and reach your goals.

In this guide, you’ll learn how to build your monthly budget from scratch in a practical and straightforward way — with visual tools to guide you.

1. What Is a Monthly Budget?

A monthly budget is a financial plan that outlines your income and how you intend to spend it throughout the month. Think of it as a roadmap — with it, you know where you’re heading and how to get there.

2. Why You Need a Budget

- Prevent unnecessary spending

- Better control debts

- Save money more effectively

- Invest with confidence

- Prepare for emergencies

Even if you think you “know” your finances, writing everything down makes a big difference.

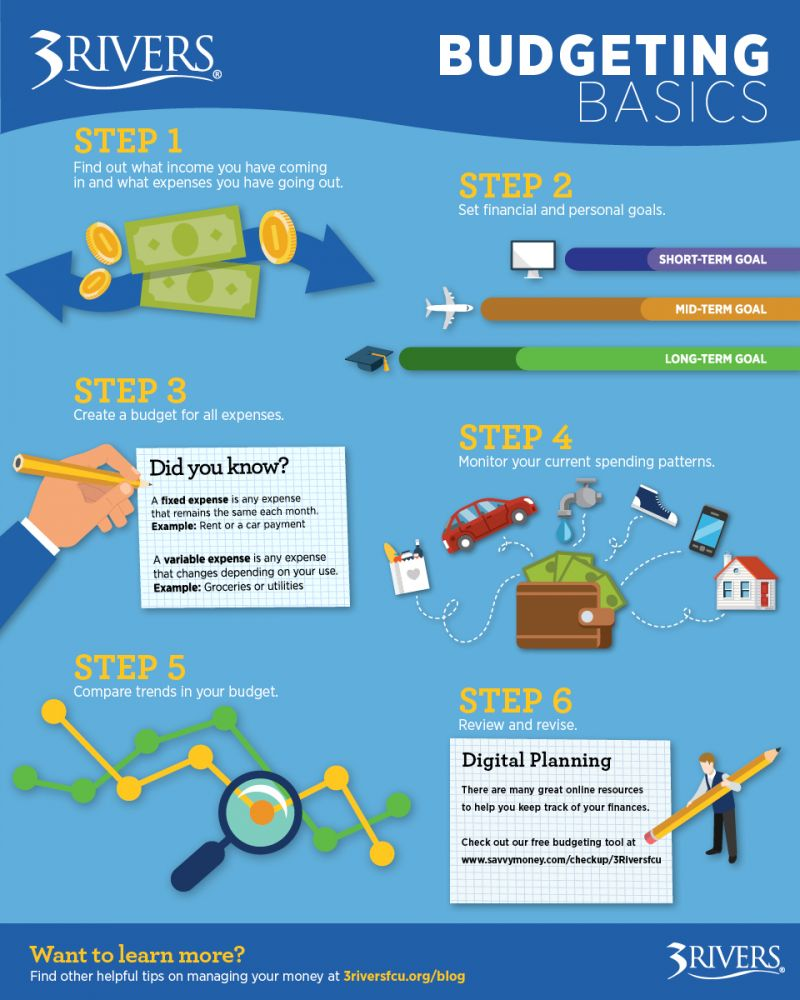

3. Step 1: Know Your Net Income

Record your net income—the amount that actually goes into your account after taxes and deductions. If your income varies (like freelancing), average it over the last 2–3 months.

4. Step 2: List All Expenses

Categorize your expenses:

Fixed Expenses (same every month):

- Rent/mortgage

- Utilities (electricity, internet)

- Insurance, school fees

Variable Expenses (fluctuate monthly):

- Groceries

- Gas or transit

- Dining out, entertainment

- Shopping, subscriptions

Use bank statements or credit card bills to capture every expense create.microsoft.com+4sofi.com+4monday.com+4monday.com+3thinklikeagirlboss.com+33riversfcu.org+3create.microsoft.com+1create.microsoft.com+1.

5. Step 3: Compare Income vs. Expenses

Calculate:

Total Income – Total Expenses = Monthly Balance

- Positive balance: you’re spending less than you earn

- Negative balance: time to cut costs or earn more

6. Step 4: Allocate Category Limits

Assign spending caps, e.g.:

- Food: $500

- Entertainment: $200

- Transport: $150

Use the 50/30/20 rule as a baseline — 50% needs, 30% wants, 20% savings/debt sofi.com+2monday.com+2monday.com+2.

7. Step 5: Track Spending Throughout the Month

Regular tracking is essential. Write down or log purchases daily. Use tools like Mint, YNAB, or PocketGuard. Visual snapshots—like charts—help you stay aware .

8. Step 6: Review & Adjust

At month-end, ask:

- What categories overshot?

- Any surprise expenses?

- Did you save as planned?

Use what you learned to refine next month’s budget etsy.com+8chartexpo.com+83riversfcu.org+8thinklikeagirlboss.com+73riversfcu.org+7monday.com+7.

9. Bonus Tips for Budgeting Success

- Consistency over perfection: regular tracking matters more than flawless entries

- Goal-oriented: tie your budget to clear objectives

- Impulse control: pause non-essential buys

- Shopping lists: especially for groceries

- Find small savings: transit, utilities, subscriptions

- Separate savings: keep them in a different account

Final Thoughts

Your money deserves a plan. A budget brings clarity, control, and confidence over your finances—empowering you to make intentional decisions with every dollar. If you haven’t started one yet, today is the day. Small steps now lead to big results tomorrow.