From post-pandemic recovery to global energy crises and central bank interventions, the 2020s have been a decade marked by one dominant economic force: inflation. Its influence on investments has been profound, shifting strategies, reshaping asset classes, and redefining risk tolerance. In this article, we’ll explore how inflation impacted various markets and investor behavior from 2020 to 2025.

What Triggered Inflation Today?

The inflation surge began in the wake of the COVID-19 pandemic. Several key factors drove price increases globally:

- Massive government stimulus: Trillions of dollars were injected into economies to support consumers and businesses.

- Supply chain disruptions: Lockdowns and global restrictions hindered production and distribution.

- Labor shortages: Resignations and remote work preferences strained employment sectors.

- Energy price volatility: Wars, OPEC decisions, and climate-related disruptions pushed oil and gas prices up.

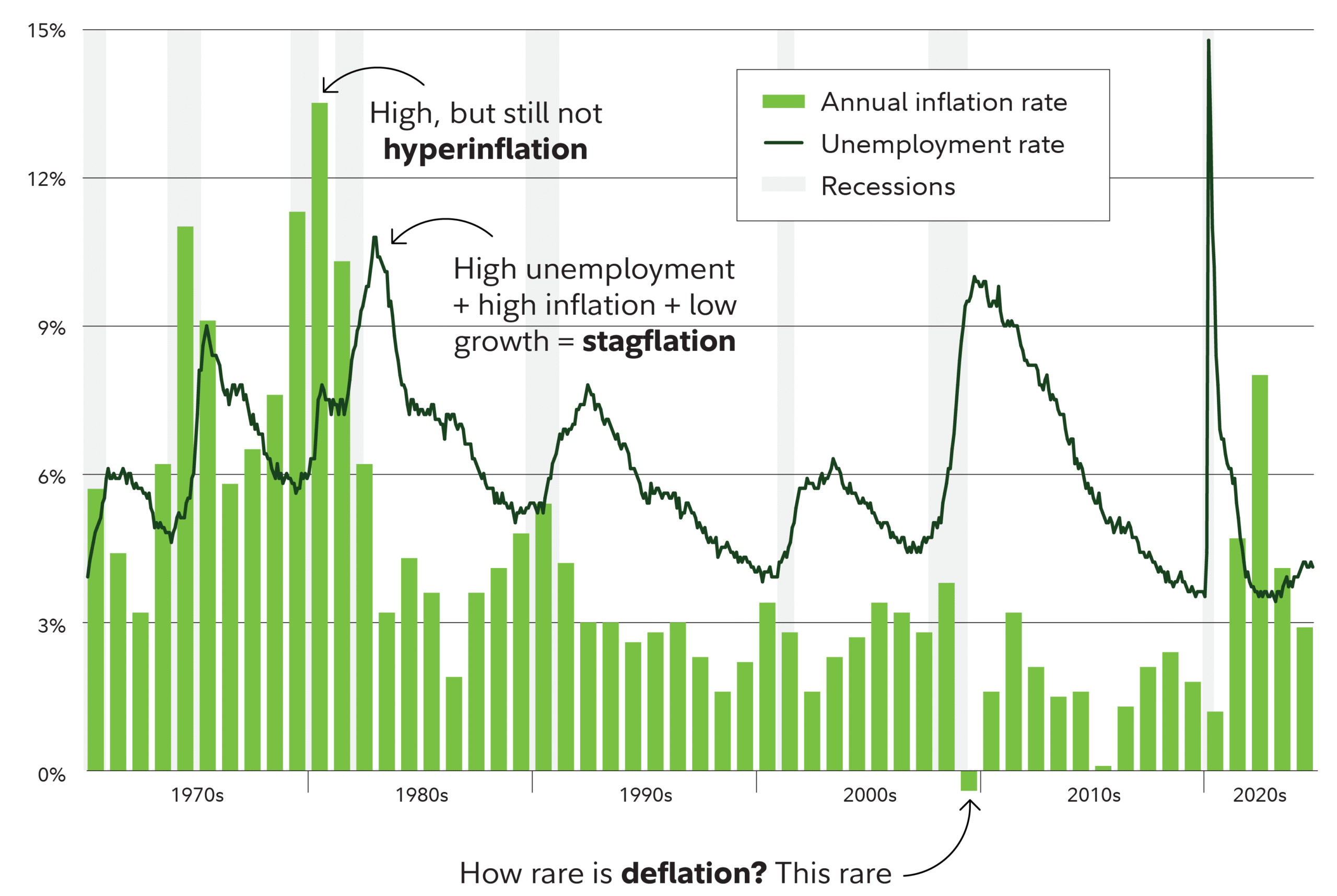

By 2022, many countries experienced inflation rates not seen in decades. The U.S., for instance, hit over 9% annual inflation in mid-2022—the highest since the early 1980s.

Impact on Stocks and Equities

Inflation reshaped the stock market dramatically.

1. Growth vs. Value Stocks

- Growth stocks, especially in tech, faced pressure due to rising interest rates. Their valuations rely on future cash flows, which become less attractive during inflation.

- Value stocks, like industrials, energy, and consumer staples, outperformed as they had stable earnings and pricing power.

2. Sector Rotation

Investors rotated out of high-growth sectors into inflation-resilient industries:

- Energy: Benefited from rising oil and gas prices.

- Utilities: Provided consistent cash flows and dividends.

- Materials and Industrials: Gained from infrastructure spending and commodity booms.

Impact on Bonds and Fixed Income

Bonds typically suffer in inflationary environments, and the 2020s were no exception.

- Rising interest rates led to bond price declines, especially for long-duration securities.

- Inflation-Protected Securities (TIPS) gained popularity as they adjust principal for inflation.

- Floating-rate bonds and short-duration treasuries became investor favorites to mitigate duration risk.

Investors became more selective with fixed income, focusing on yield, credit quality, and inflation hedges.

Impact on Real Estate

Real estate had a complex relationship with inflation in the 2020s.

- Residential real estate boomed in 2020–2021 due to low interest rates and remote work. But high inflation later led to rate hikes, cooling demand.

- Commercial real estate faced challenges, especially office spaces, as hybrid work became permanent.

- REITs (Real Estate Investment Trusts) offered mixed results: those focused on logistics and residential fared better than retail and office-focused REITs.

Inflation drove property values up in many areas, but affordability concerns and mortgage rate hikes tempered long-term momentum.

Inflation and Commodities

Commodities historically serve as a hedge against inflation, and they delivered strong returns in this period.

- Gold and silver saw renewed interest as traditional inflation hedges.

- Oil and gas prices spiked due to geopolitical tensions and production cuts.

- Agricultural commodities rose due to climate challenges and supply shocks.

Investors allocated more to commodity ETFs and futures as a protective measure against currency devaluation and purchasing power erosion.

Cryptocurrencies: Inflation Hedge or Not?

Initially touted as “digital gold,” Bitcoin and other cryptocurrencies were expected to act as inflation hedges. However, results were mixed:

- 2020–2021: Crypto prices soared during low-rate environments.

- 2022–2023: As inflation peaked, cryptos fell—showing volatility rather than protection.

- 2024–2025: With more institutional adoption and regulation, crypto regained ground, but skepticism remained regarding its hedge status.

Central Bank Actions and Market Reactions

To curb inflation, central banks—especially the U.S. Federal Reserve—aggressively raised interest rates from 2022 onward.

- Fed rate hikes moved from near-zero to over 5% in less than two years.

- Quantitative tightening reduced balance sheets, reversing years of stimulus.

- Global coordination: ECB, BOE, and other central banks followed suit.

These moves impacted all asset classes:

- Mortgage rates soared.

- Tech stocks corrected.

- Borrowing costs for businesses and consumers increased.

Inflation-Driven Investor Behavior

Investors adjusted strategies to protect their portfolios:

- Rebalancing portfolios toward inflation-resistant sectors.

- Seeking dividend-paying stocks for income during market uncertainty.

- Diversifying internationally to find regions with lower inflation or stronger currencies.

- Investing in hard assets like gold, real estate, and infrastructure.

Risk tolerance also shifted. Volatility made investors more cautious, favoring defensive assets and income generation over speculation.

The 2025 Inflation Outlook

By mid-2025, inflation has begun to stabilize, but at a higher baseline than the 2010s. Expectations include:

- Moderate inflation (~3%) becoming the “new normal.”

- Monetary policy caution, with central banks hesitant to return to ultra-low rates.

- Continued supply chain adaptation, including nearshoring and AI-driven logistics.

- Increased focus on inflation resilience in portfolio management.

What Investors Should Learn

Inflation in the 2020s taught investors to:

- Expect the unexpected: markets can reverse quickly.

- Hedge with real assets and diversify widely.

- Monitor central bank signals and macro trends closely.

- Avoid overexposure to growth assets in rising-rate environments.

Staying informed and agile became essential. Inflation may cool, but its impact on portfolio strategy is here to stay.