As prices rise and your money buys less over time, inflation quietly erodes your wealth. To preserve your purchasing power, savvy investors use inflation-protected investments—financial tools designed specifically to shield savings and returns from the impact of rising costs.

One of the most trusted tools in this category is the TIPS (Treasury Inflation-Protected Securities). In this guide, you’ll learn what they are, how they work, and how to integrate them into a well-balanced portfolio.

📈 Understanding Inflation

Inflation refers to the general increase in prices over time. As inflation rises, the same amount of money can buy fewer goods and services.

Real-world examples of inflation:

- A gallon of milk costing $3.00 today might cost $3.30 next year

- $10,000 in a savings account earning 1% may lose value if inflation is 4%

Even modest inflation (e.g., 2–3% per year) can significantly reduce your purchasing power over decades. That’s why protecting your money against inflation is crucial, especially for long-term savers and retirees.

🛡️ What Are TIPS?

TIPS are a type of U.S. Treasury bond designed to protect investors from inflation.

- Issued by: U.S. Department of the Treasury

- Maturity terms: 5, 10, or 30 years

- Interest: Paid twice a year (fixed rate)

- Principal: Adjusted regularly based on CPI (Consumer Price Index)

Key Mechanism:

The principal increases with inflation. Since the interest is calculated based on the adjusted principal, both your interest payments and final payout grow over time.

🔍 Example: How TIPS Work in Practice

Imagine you buy $1,000 in TIPS with a 1% annual fixed interest rate.

- Year 1: Inflation is 3%. Your principal becomes $1,030. Interest = 1% of $1,030 = $10.30

- Year 2: Inflation is 2%. Your principal becomes $1,050.60. Interest = 1% of that = $10.51

At maturity, you receive either:

- The inflation-adjusted principal, or

- The original $1,000, whichever is higher

💡 Benefits of TIPS

✅ Inflation Protection

Your investment grows in line with the actual cost of living.

✅ Low Risk

Backed by the U.S. government—considered one of the safest investments available.

✅ Reliable Income

Biannual interest payments provide stability, especially for retirees.

✅ Diversification Tool

Great for balancing a portfolio that includes more volatile assets.

⚠️ Downsides and Risks

🚫 Lower Yields Compared to Other Bonds

In stable or deflationary periods, traditional bonds or stocks may outperform TIPS.

🚫 Taxable Adjustments

Inflation adjustments to principal are taxable annually, even though you don’t receive that money until maturity—this is known as phantom income.

🚫 Not Ideal for Short-Term Investing

TIPS shine in the long-term, but may lag behind in short periods with low inflation.

💡 Tip: Consider holding TIPS in a Roth IRA or Traditional IRA to avoid annual taxation on inflation adjustments.

💼 Where and How to Buy TIPS

1. TreasuryDirect.gov

Buy directly from the U.S. government. No fees, but interface is basic.

2. Brokerage Firms (Fidelity, Vanguard, Schwab)

Access TIPS through your regular brokerage account.

You can buy individual TIPS, mutual funds, or ETFs.

3. ETFs and Mutual Funds

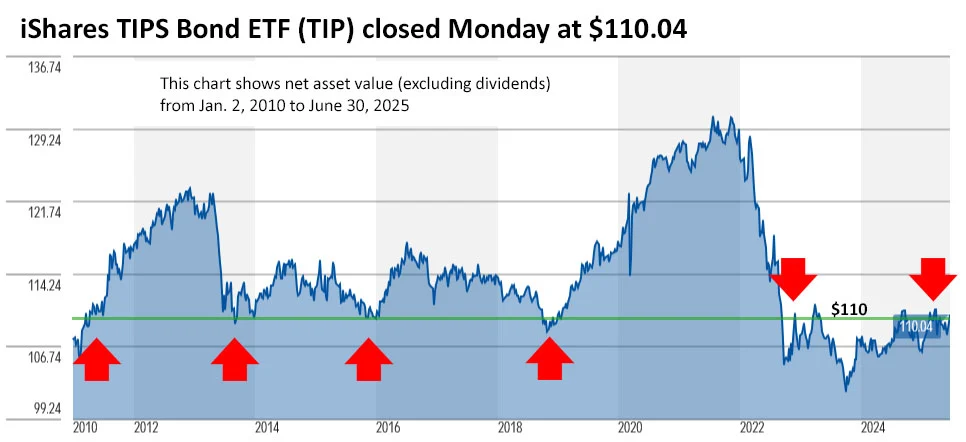

- TIP – iShares TIPS Bond ETF

- VTIP – Vanguard Short-Term TIPS ETF

- SCHP – Schwab U.S. TIPS ETF

These are ideal for investors who prefer diversification and convenience.

🔄 Other Inflation-Hedged Investments

📊 Series I Savings Bonds

- Also backed by the U.S. government

- Combine a fixed interest rate with a variable inflation-based rate

- Can be purchased online, up to $10,000/year per person

🪙 Commodities

- Gold, silver, oil tend to hold value in inflationary times

- Higher volatility, not income-producing

🏠 Real Estate

- Property values and rental income typically rise with inflation

- More hands-on and less liquid, but a strong hedge over the long term

🧱 REITs (Real Estate Investment Trusts)

- Stocks that pay dividends from property income

- Accessible, inflation-responsive, but market-exposed

📈 Stocks

- Companies with pricing power can pass inflation costs to customers

- Historically outperform inflation over long periods

🧠 When Should You Use TIPS?

TIPS may be right for you if:

- You’re nearing retirement and want protection, not just growth

- You want to diversify your bond holdings

- You’re concerned about rising inflation

- You seek stability and predictable income

Even if you’re in your 30s or 40s, allocating a small portion of your portfolio to TIPS can provide long-term balance.

📘 Final Thoughts: A Smart Shield for Smart Investors

TIPS and other inflation-protected investments are essential tools for defending your wealth in an unpredictable economy. They won’t make you rich overnight, but they’ll help ensure the money you have keeps its real-world value.

Diversify wisely. Protect your purchasing power. And keep your financial strategy ready for whatever the economy throws your way.