Choosing the right bank account is one of the first steps toward managing your money effectively. But with so many options—checking, savings, digital, high-yield, and more—it can be confusing to know which one fits your needs.

In this article, we’ll explain the main types of bank accounts, what they’re for, and how to pick the best one for your financial goals.

Why Bank Accounts Matter

Bank accounts help you:

- Safely store your money

- Access it easily for daily use or emergencies

- Earn interest on your savings

- Keep your finances organized

- Avoid carrying cash and improve security

They’re also key to building your financial credibility.

1. Checking Account

What it is:

A basic bank account for everyday spending. It’s where your paycheck is deposited and where bills, groceries, and transfers usually come from.

Features:

- Easy access via debit card, checks, or app

- Usually no interest earned

- May include online bill pay

- May charge monthly fees (some can be waived)

Best for:

Daily use, paying bills, managing income and expenses

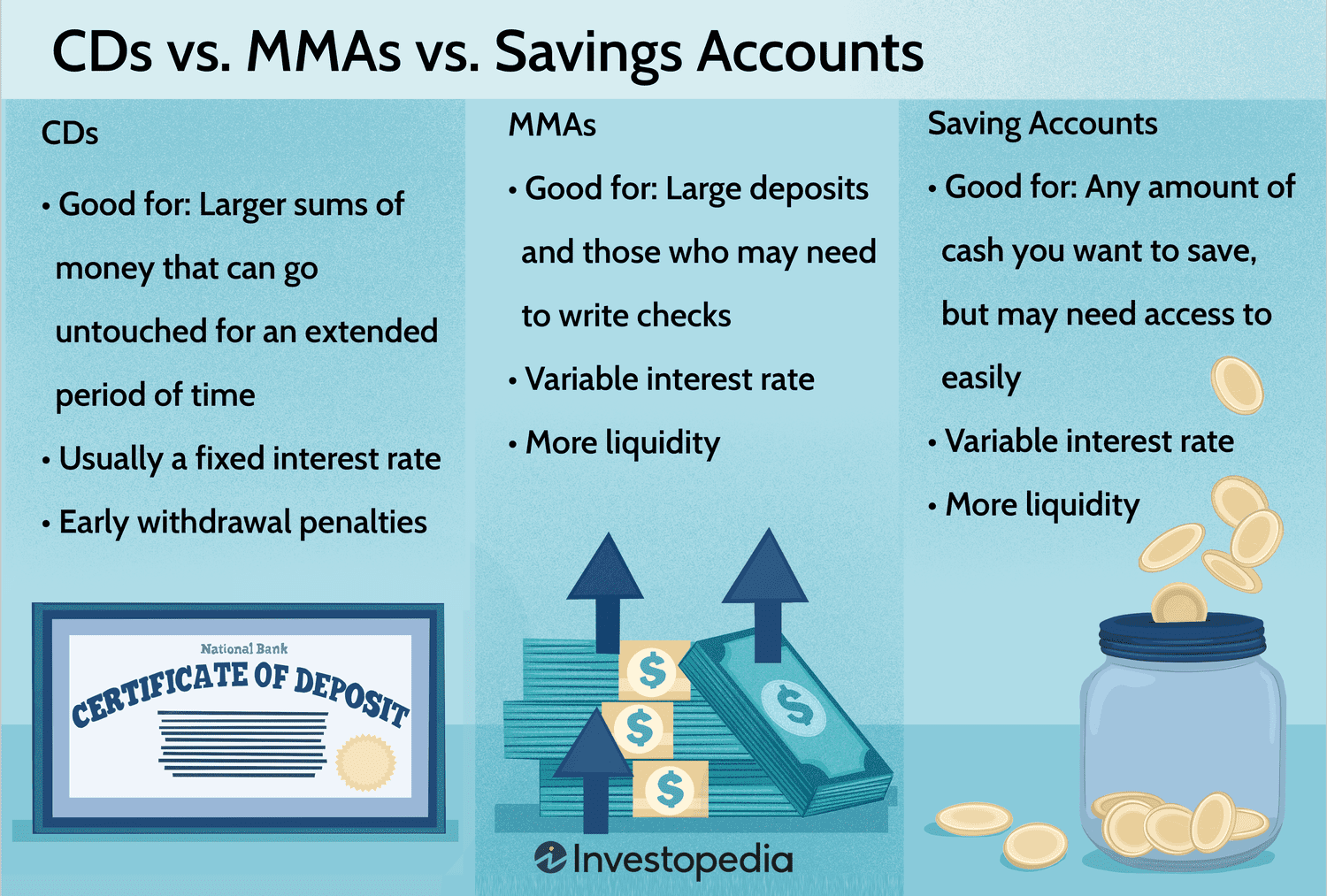

2. Savings Account

What it is:

A bank account meant for storing money you don’t plan to spend immediately.

Features:

- Pays low interest

- Limits on withdrawals per month

- Separate from your main spending account

- FDIC-insured (in the U.S.)

Best for:

Emergency funds, short-term savings goals

3. High-Yield Savings Account

What it is:

A type of savings account—usually offered by online banks—that pays higher interest than traditional savings.

Features:

- Interest rates 10x+ traditional savings

- Often no fees

- Typically no physical branches

Best for:

Growing your savings faster with low risk

4. Money Market Account

What it is:

A hybrid between a savings and checking account.

Features:

- Higher interest than standard savings

- Limited check-writing privileges

- Higher minimum balances often required

Best for:

Savers with larger balances who want flexibility and interest

5. Certificate of Deposit (CD)

What it is:

A timed deposit where your money is locked for a set period (e.g., 6 months, 1 year, 5 years).

Features:

- Higher interest rates the longer you commit

- No access until the term ends (or early withdrawal penalties)

Best for:

Planned savings you won’t need right away

6. Digital/Neobank Accounts

What it is:

App-based banks with no physical branches (e.g., Chime, N26, Nubank).

Features:

- Low/no fees

- Intuitive budgeting tools

- Quick transfers and payments

- May lack traditional services (like check deposits)

Best for:

Young professionals, tech-savvy users, and budgeting on-the-go

How to Choose the Right Bank Account

Ask yourself:

- What’s the purpose of this account? (daily use, saving, investing)

- Do I need branch access or prefer mobile?

- How often will I deposit/withdraw?

- Do I want to earn interest or avoid fees?

You may need more than one account for different purposes.

Final Thoughts: The Right Account Supports Your Goals

Choosing the right bank account isn’t just about features—it’s about making your money easier to manage and grow. Whether you’re saving for a vacation, paying monthly bills, or starting an emergency fund, there’s an account that fits your needs.

Understand the options. Open with confidence. And align your accounts with your future.