If you’re just getting started on your financial journey, you’ve probably heard advice like “start saving early” or “invest for the future.” But what’s the actual difference between saving and investing—and when should you do each?

In this article, we’ll break it down clearly so you know when to save, when to invest, and how to use both strategies to build a secure financial future.

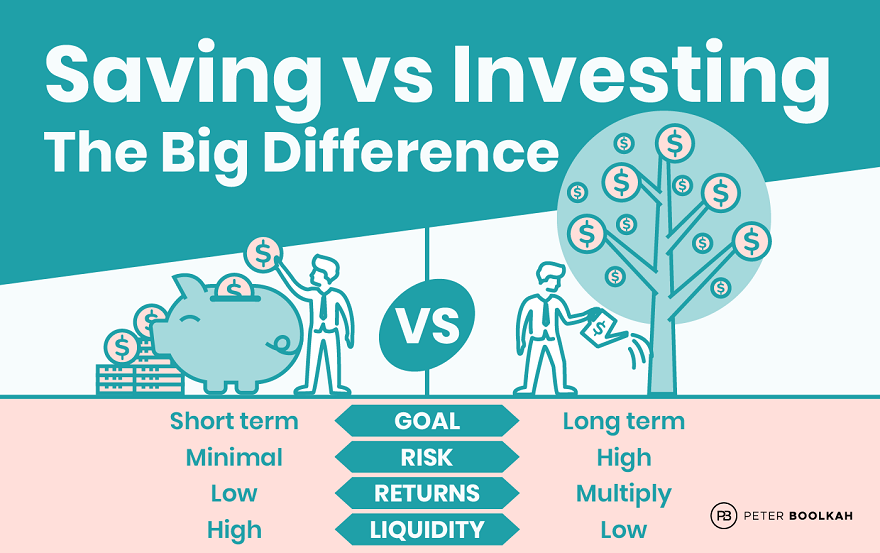

Saving vs. Investing: Quick Comparison

| Feature | Saving | Investing |

|---|---|---|

| Purpose | Short-term safety | Long-term growth |

| Risk Level | Very low | Moderate to high |

| Return Potential | Low (1–5% annually) | High (6–12% or more annually) |

| Liquidity | High (easy to access) | Medium to low (some assets harder to sell) |

| Common Tools | Savings account, CD | Stocks, ETFs, real estate, mutual funds |

What Is Saving?

Saving is putting money aside in a safe place for short-term needs or emergencies. It’s easy to access, and there’s little or no risk of losing money.

When to Save:

- Emergency fund (3–6 months of expenses)

- Short-term goals (vacation, new phone, car down payment)

- Unexpected expenses

- Big purchases in the next 1–3 years

Best Places to Save:

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Money market accounts

What Is Investing?

Investing is using your money to buy assets that are expected to grow in value or provide income over time. There’s more risk—but more potential for returns.

When to Invest:

- Retirement (IRA, 401(k))

- Buying a home in 5–10 years

- Building long-term wealth

- Saving for a child’s education

Common Investment Vehicles:

- Stocks and ETFs

- Mutual funds

- Bonds

- Real estate

- REITs (Real Estate Investment Trusts)

Key Differences in Mindset

- Saving is about security and accessibility

- Investing is about growth and future goals

You save to protect what you have.

You invest to grow what you have.

How to Use Both Strategies Together

Step 1: Start with Saving

- Build your emergency fund first

- Save for near-term goals (less than 3 years)

Step 2: Begin Investing Consistently

- Start small (even $50/month)

- Use tax-advantaged accounts

- Focus on long-term consistency, not timing the market

Step 3: Maintain a Balance

- Keep savings accessible

- Let investments grow quietly over years

- Adjust as your income and goals evolve

Mistakes to Avoid

- Investing before having an emergency fund

- Keeping all money in savings and missing growth

- Panicking during market drops

- Using savings accounts for long-term goals

Final Thoughts: Save First, Then Invest for Growth

Both saving and investing are critical to financial health—but they serve different purposes. Saving protects you from the unexpected. Investing helps you reach what seems impossible.

Start where you are. Save smart. Then invest with confidence—and let your money work for you.